We know you have a lot to do when you’re running your own small bar, so you probably don’t have time to sift through the different types of insurance policies available on the market. That’s where we can help. After getting to know your business and your budget, we’ll weigh up all the risks and your unique business situation and suggest policies tailored to your small bar. Below are some of the different types of insurance you need to consider for your venue.

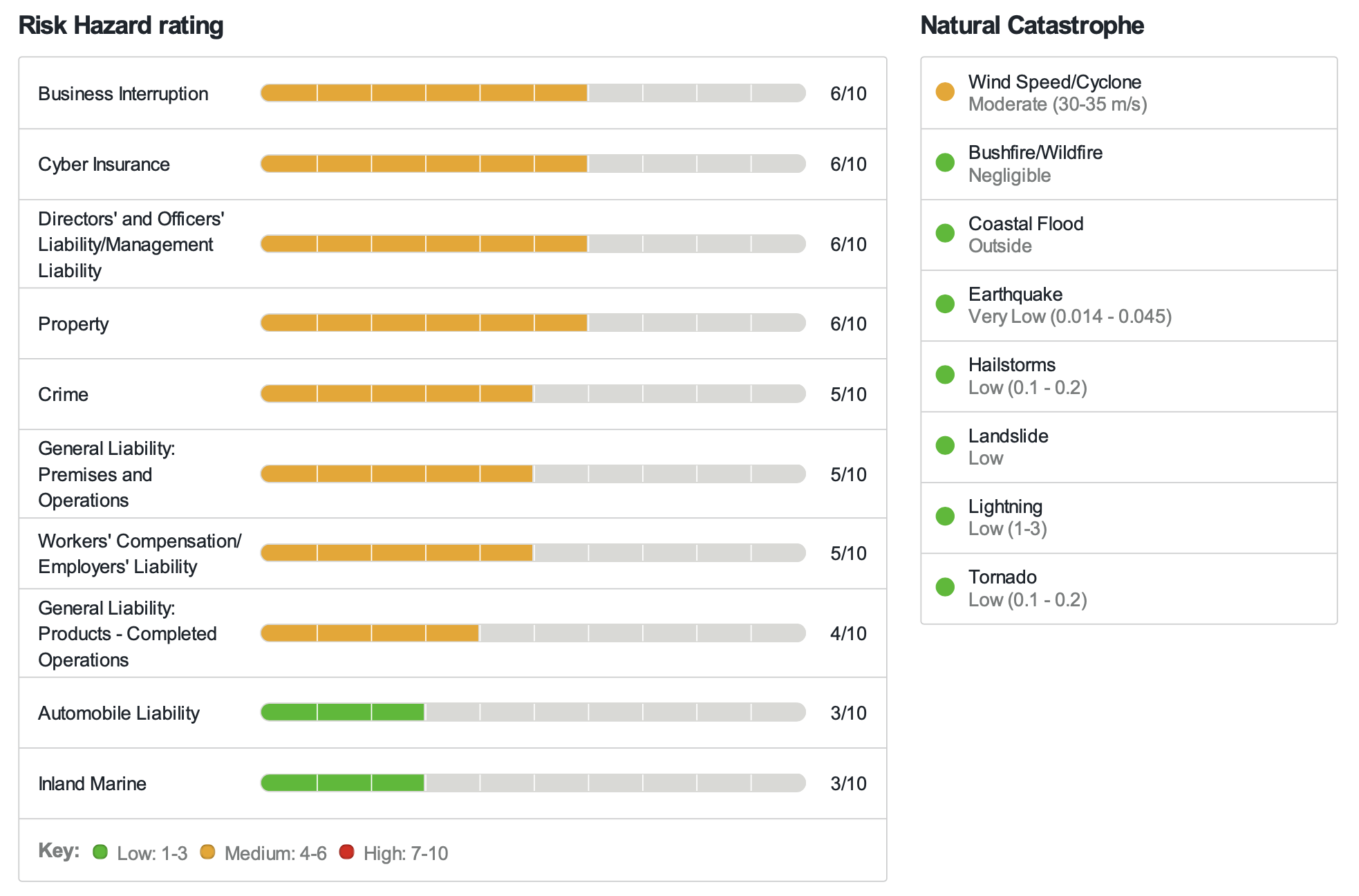

iProfileRisk is a tool we use to identify and understand our client’s unique risk landscape.

Each year we provide our clients with a free iProfileRisk Report prior to renewal to give you visibility over potential exposure areas.

See here for a snapshot of the iProfileRisk report for Small Bars.

At Phoenix Insurance Brokers, we know insurance can be complex and challenging. That’s why we work alongside our clients making sure they have the best level of protection. And, as a valued Phoenix client, in the event of a claim, we always go the extra mile to ensure all entitlements are received.

Every small bar is different, with different business insurance requirements. That’s why there’s a range of insurance policies on the market to protect your business.

Your Phoenix Insurance Broker knows and understands hospitality and its risks and can work with you to make sure you have the right business insurance cover in place for your small bar.

Insurance is complex. Knowing which policies to choose from to protect your business involves specialist knowledge. Phoenix Insurance Brokers has been providing insurance advice to Western Australian businesses for more than 30 years. We have the knowledge and experience to know what you need to protect your small bar and our service is second to none. We also know you’ll love our friendly and highly qualified team.

Using Phoenix Insurance Brokers Perth gives you access to economies of scale and insurance packages that have been specially developed through our alliance with the Steadfast Group, Australia’s largest insurance broker cluster group. Our Steadfast alliance ensures our clients receive Phoenix’s signature personalised service together with the benefits of Steadfast’s impressive buying power.

Phoenix can assist with all your general insurance needs including accessing and reviewing your insurance, full claims management, arranging premium funding and risk management.

Not only will your Phoenix Insurance Broker help you decide which policies are right for your venue, they can also package multiple policies together so you only pay one premium that you can spread out over a year (to assist with cash flow). Your Phoenix Broker will also work with you to make sure your insurance changes as your business changes, so you’re only paying for what you need or you’re adding cover as your business grows.

We’re here to assist you every step of the way. With three locations throughout the state in South Perth, Busselton, and Broome, one of our branches is local to you. Our head office is in Canning Hwy in South Perth. Our Broome office represents our clients in the state’s North-West while our Busselton office has been servicing our clients in the South-West for almost 20 years. We also cater to clients in the Rockingham and Peel regions.

The most common types of small bar insurance are Public Liability, Product Liability, and Business Interruptions which can cover your restaurant premises, your contents, any machinery and equipment breakdowns, business interruption, glass, and money (if cash is stolen, lost or damaged somehow).

You must have workers’ compensation insurance for anyone you employ at your small bar including full-time workers on a wage or salary, part-time, casual, and seasonal workers. This is one of the most important types of insurance restaurant businesses should invest in.

In the event you need to make a claim, get in touch with your Phoenix Insurance Broker and we’ll guide you from there. Remember that we work for you, not the insurance company. Whether you need advice, you need to make a claim on your small bar insurance or change your policy, your Phoenix Broker will take care of all your small bar insurance needs.

Yes, you can make changes to your insurance policy. If things change, like your address, or your small bar grows and you employ more staff, and you want to make sure your insurance still covers you, simply call your Phoenix Insurance Broker on (08) 9367 7399 or email us at info@phoenixins.com.au.

Your small bar insurance renewal offer will be sent to you prior to the renewal date. Once you are happy with the details (taking into account any changes in cover and price), all you’ll need to do is pay your renewal by the due date. Your Phoenix Broker is there to discuss with you at any stage of the renewal process.

It’s up to you! Your Phoenix Insurance Broker can work with you to not only bundle your small bar insurance policies into a package that’s tailored to your requirements, but they can also help you to manage your premiums by showing you how you can pay them monthly to assist with cash flow or if you prefer, paying them annually.

For all your small bar insurance needs and questions, contact us on (08) 9367 7399 or at info@phoenixins.com.au. You can also view our full contact details and locations.

Team Atsure specialise in:

Team Atsure specialise in:Opening your own Small Bar is the realisation of a long-held dream for some.

Read More

Whether you’re a talented bartender or your skills lie in welcoming patrons to your establishment, you’re likely to have people coming and going, and often at a fast pace.

Sifting through the myriad of business insurance policies on the market and knowing what insurance you need can be a minefield. That’s when an experienced insurance broker who can guide you through the maze and explain the pros and cons of insurance can be very helpful.

However you choose to run your Small Bar, one thing is certain – Small Bar business insurance is essential to cover you if and when the unexpected happens. When you’re in the hospitality industry and you’re dealing with the public, this tends to be a certainty rather than a maybe.

There’s a host of small bar insurance policies on the market from which you can choose such as products liability insurance and workers’ compensation insurance. There might also be compulsory insurance such as public liability for example, which landlords usually require you to have – but there are also certain types of insurance you shouldn’t be without if you want to protect your business.

If you operate your business in WA, NT, QLD, NSW, ACT, VIC, TAS or SA

– our hospitality insurance brokers can help.

Insurance can be complex. Often you think you’re doing the right thing by taking out a particular policy, only to find you’re not adequately covered for a scenario when it comes to making a claim. This can be costly, time-consuming and frustrating.

Read MoreAs experienced business insurance brokers who understand small business and the hospitality industry, Phoenix can work with you to ensure you have the right policies in place to protect your small bar so that if the worst should happen, or something unforeseen occurs, you can get back to serving your customers as soon as possible. With Phoenix Insurance Brokers, we can take care of the details, giving you peace of mind and leaving you to get on and do what you do best.

Some people dream of running their own bar but that doesn’t mean there aren’t challenges and risks along the way and a lot of hard work. While we can’t help you serve your customers, we can put you on the right path when it comes to insurance. Whether you’re starting something from scratch or buying a franchise, and whether your venue seats 20 or 100, having the right insurance in place is essential to protect your business against unexpected challenges.

Opening your own small bar can be hugely rewarding. Of course, it’s a lot of hard work, but the joy of creating your own atmosphere, amazing drinks and great memories for your customers can be a very satisfying experience. Or perhaps you’re already going and insurance has been on your ‘to do’ list. Now that we’ve covered the basics and some insurance options for you to consider above, there’s no better time than today to get in touch with your local Phoenix Insurance Broker to talk about how we can help you safeguard your venue.

While insurance is our business, our philosophy is about people and building strong, solid relationships with them. We partner with all our clients to achieve the best possible outcomes, for them, their families, and their businesses.

Copyright © Phoenix Insurance Brokers Pty Ltd | All rights reserved. Optimised by White Chalk Road.